Baoxin View

On the boundary of legal due diligence from Ruixing Coffee's financial fraud

Release time:2020-04-07

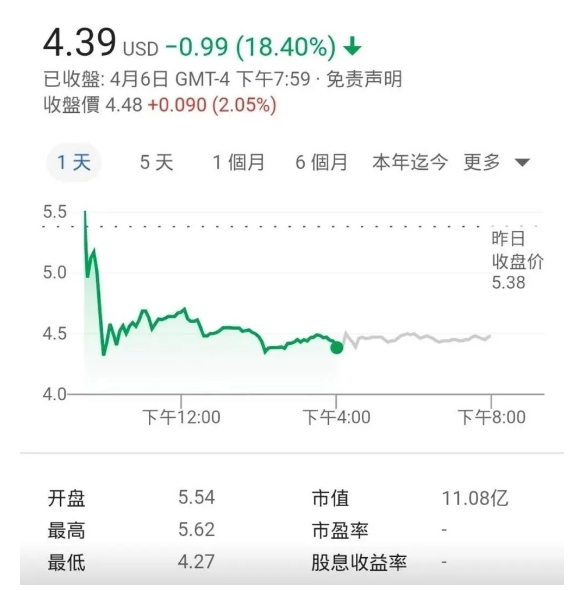

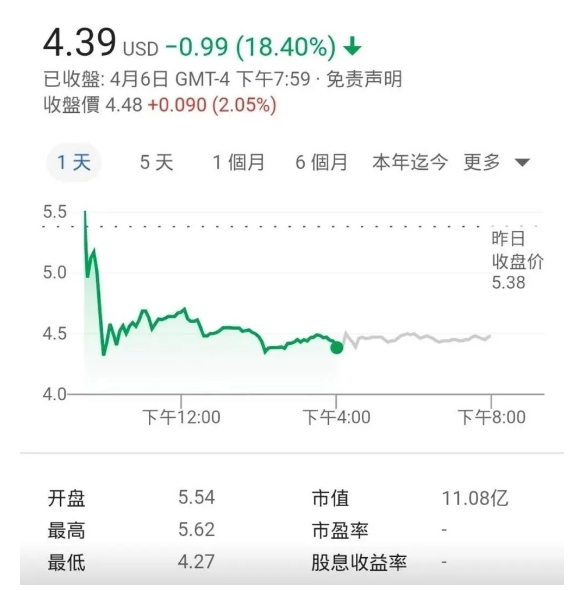

I believe that the most popular economic news in the past two days is the financial fraud of Luckin Coffee. The short-selling organization "MuddyWaters Research" released an 89-page short report on the stock of "Luckin Coffee". Luckin Coffee blew up its financial fraud on April 2nd, Eastern Time. The scale of fraud was as high as 2.2 billion. Luckin's stock fell in response, triggering a circuit breaker 6 times during the session, and the decline has reached 80%.

Analysis of the punishment faced by the Ruixing incident Ruixing Coffee’s financial fraud of 2.2 billion and other illegal operations will face multiple civil, administrative, and criminal penalties. First of all, in terms of civil compensation, many law firms in the United States have filed a class action lawsuit against Ruixing Coffee, accusing Ruixing Coffee of making false statements and misleading statements, violating the US Securities Law, and Ruixing Coffee will face huge compensation. No suspense. In terms of administrative penalties, it can also be seen from the former car of the large-scale counterfeit Enron that Ruixing Coffee has suffered huge and heavy penalties, and even has a high probability of delisting and bankruptcy. Finally, once Ruixing Coffee’s directors, supervisors, and actual controllers commit malicious fraud, they may be subject to criminal penalties. In addition, from a domestic regulatory perspective, Article 2 of the Securities Law revised in 2019 stipulates: “Securities issuance and trading activities outside the People’s Republic of China disrupt the market order in the People’s Republic of China and damage the legitimate rights and interests of domestic investors. Handle and pursue legal liabilities in accordance with the relevant provisions of this law.” According to this, Luckin Coffee may become the first Chinese concept stock company under long-arm jurisdiction determined by the new Securities Law to be punished by both China and the United States for financial fraud. Muddy Water’s short-selling report pointed out Ruixing’s fraudulent and basically collapsed businesses through thorough and detailed investigations. The report respectively showed how Ruixing falsified data and why its business model has inherent flaws. In fact, Luckin Coffee has been questioned from the beginning. When Luckin Coffee went public in May 2019, it basically maintained its business through high discounts, and its business model had fundamental flaws. Luckin's flawed unit economic benefits that cannot make a profit are doomed to its business model will inevitably collapse. But Luckin and the various capitals that helped it incubate at a high speed know exactly where the investor’s sense of smell is and how to position itself as a company with rapid growth and a wonderful story. As a law firm, we are concerned about the role of intermediaries in Ruixing Coffee’s securities fraud and the legal responsibilities they face. The intermediary team of Luckin Coffee's IPO includes Credit Suisse, Morgan Stanley, CICC International, and Haitong International as their joint underwriters; Ernst & Young as its audit agency. These subjects will face a severe burden of proof, and it is not easy to get out of it intact. If the law firm fails to perform its duties in the legal due diligence, it will also face investigation and punishment.A brief analysis of legal due diligence So, as a law firm that conducts legal due diligence, do we need to conduct due diligence on contingent business risks and disclose the risks? How to grasp the investigation boundary of legal due diligence? There are many types of due diligence, usually including legal due diligence, financial due diligence, commercial due diligence, etc. Different types of due diligence are generally handled by different professional organizations, and there will be communication and collaboration among professional organizations. However, there is no clear gap between professional investigations, and legal due diligence is not limited to legal review. In the case of Xintai Electric’s IPO law firm and its lawyers v. China Securities Regulatory Commission for administrative punishment, the Beijing No. 1 Intermediate People’s Court pointed out in its judgment: “In the process of due diligence, the law firm shall take Conduct a comprehensive and comprehensive analysis of relevant materials, and independently issue legal opinions on the overall situation of the company on the basis of prudential inspection and be responsible for the conclusions. Legal due diligence and financial statement auditing belong to different levels and different types of work, and due diligence is not for audit reports The review of itself and the audit report cannot be the basis for exempting the law firm from diligence obligations. Accounts receivable are matters that the law firm should pay full attention to and special inspection during the legal due diligence process. Accounts receivable affect the company One of the important factors of financial situation, and fictitious collection of accounts receivable is a common method for companies to conduct financial fraud. Therefore, law firms should not only pay attention to accounts receivable when conducting legal due diligence on the company’s financial situation. , And whether there are legal risks in the collection of accounts receivable, including the authenticity of the balance of accounts receivable, legal risks of due collection, etc., should be carefully examined as a special issue. The plaintiff believes that the collection of accounts receivable is Financial accounting issues, so the law firm has no obligation or ability to conduct inspections, which does not meet the basic requirements of legal due diligence. In this case, there is no evidence that Dongyi has prepared a special inspection plan before conducting legal due diligence, let alone Evidence proves that it has formulated a special inspection plan for Xintai Electric’s accounts receivable. In Dongyi’s working paper, it simply summarizes the accounts receivable and payable vouchers, and there is no evidence to prove that it has conducted a prudent inspection. The copied interview transcripts of Industrial Securities further prove that Dongyi did not pay sufficient attention to the issue of accounts receivable. Even the evidence submitted in the three plaintiffs lawsuit and whose authenticity is still difficult to confirm cannot reflect Dongyi. The Exchange has conducted a careful inspection of the accounts receivable. The fact that Dongyi has not fulfilled its diligence obligations is undoubtedly, and Dongyi shall bear the corresponding legal responsibility for its failure to perform diligence obligations." Although in this case, the penalties imposed by the Securities Regulatory Commission and the judgments of the courts have caused great controversy, we should pay full attention to the boundaries of legal due diligence. Lawyers should maintain a cautious and skeptical attitude towards all materials encountered in due diligence, analyze the legal relationships reflected behind these materials, data, etc., and then analyze the facts on which these legal relationships should be based, and then draw on the evidence in the law of evidence The review standards of the authenticity, legality and relevance of the evidence and the highly probable standard of proof are used to identify the facts that need to be stated and issue legal opinions. When discussing the boundaries of due diligence, the position of non-litigation lawyers should also be clarified. Non-litigation is different from litigation. Litigation is a zero-sum game most of the time, but non-litigation is a win-win game most of the time. Through due diligence, non-litigation lawyers help clients prompt risks, better design transaction structures, choose future exit paths, perfect transactions as much as possible, and promote more perfect transactions. This is the focus of due diligence. There are two common misunderstandings that lawyers make in non-litigation business. One is that the role of lawyers is to "picking faults" and to set obstacles to transactions. In a commercial negotiation we participated in, a lawyer proposed that “the transaction deposit cannot be co-managed, and must be paid directly to my client when the counterparty is the top three real estate developers in China. Otherwise, the co-management will not be terminated after the conditions are met. Risk”, the final transaction did not proceed because of the lawyer’s insistence. The second is that due diligence is only a formality, and the lawyer has completed the due diligence checklist and recorded it in the manuscript. Although due diligence is a highly standardized job, if it is only put into the assembly line and endorsed by the work of a lawyer, such due diligence is tantamount to a landmine that explodes at any time. We believe that legal due diligence must first understand the industry that is due to be adjusted, and understand some of the key economic indicators, policies and economic environment, industry competition pattern, industry chain, and main business models of this industry. Through due diligence, the law firm should discover and prompt the underlying company value risk, equity defect risk, asset defect risk, contingent debt risk, sustainable operation risk, and other risks including legal and policy revision risks, market access risks, and participation Main body, decision validity risk, etc. Obviously, these risks must include not only legal risks, but also commercial risks. In addition to discovering and revealing these risks, lawyers should also propose solutions together, or fully remind the risks that there is no solution. In the book "The Lost Lawyer", Croman believes that "prudent judgment and practical wisdom" are the virtues of lawyers. For non-litigation lawyers, legal due diligence is a concentrated expression of prudent judgment and wisdom accumulated through long-term practice. Going back to the Ruixing incident, we believe that the boundary of legal due diligence should include the business risks discovered during the investigation by lawyers, which should be paid attention to and reflected in the due diligence report. The short-selling mechanism plays a special role in the securities market, and the market's correction force may be more efficient and powerful than administrative supervision. Capital has no nationality, and there is no need to kidnap morality. Whether it is an American company Enron or a Cayman-registered company Ruixing, the "rotten flesh" of illegal operations will attract short-selling "vultures." We have seen that many Chinese concept stocks are still performing well after being shorted, such as Anta Sports and New Oriental. They have withstood the test of the market and have no fear of shorting. Because, no matter which market you are in, only honesty and compliance are the least costly profitable methods.- END -